Within the next 5 years, it is estimated that $30-$100 billion within the Asia Pacific region will be required to decommission:

- 200 Offshore Fields

- 1,500 Platforms

- 7,000 Wells

Malaysia is poised to play a pivotal role in this regional development. There are two main players in the country, with PETRONAS and PTTEP owning over 60% of the fields. So far, the country has decommissioned 13,000 metric tons of subsea structures, 11 pipelines, and 9 floaters. Before the end of the decade, PETRONAS plans to decommission 153 wells and 37 offshore facilities.

Can the supply chain meet this upcoming demand?

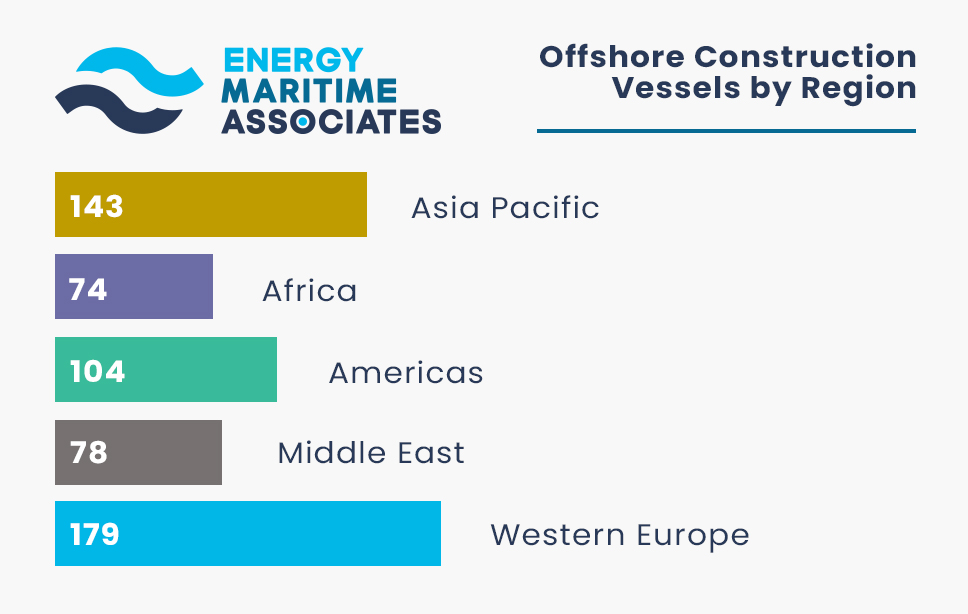

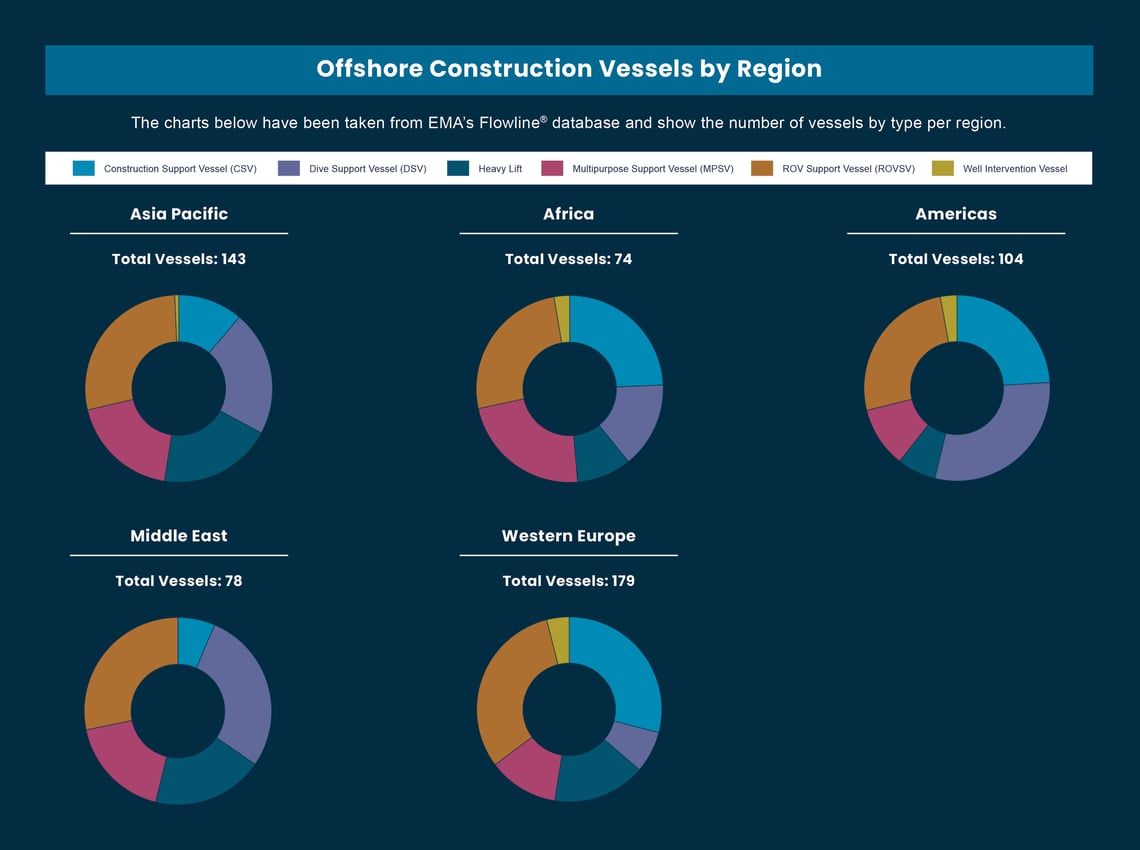

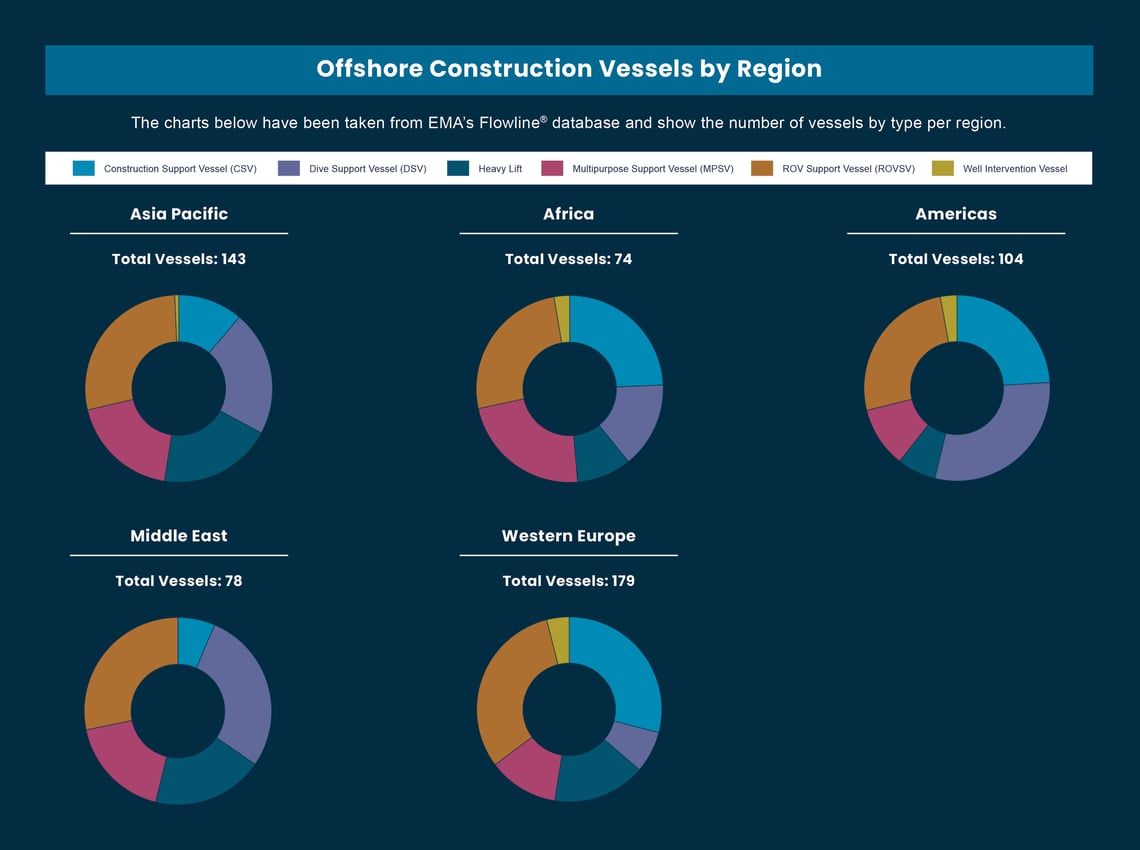

EMA’s database shows 143 marine assets (from Heavy Lift to ROV Support Vessels) currently in the In the Asia Pacific region that could execute this type of work. This compares favourably with other regions, such as Africa (74), the Middle East (78), Western Europe (179), and the Americas (104).

Asia Pacific remains a key hub for many international contractors, including Saipem, Subsea7, Fugro, and Helix. However, many of these companies already have multi-year backlogs and this same equipment could be used for projects in other regions, particularly the Americas and Middle East, where many new developments are underway. This work would also appeal to some regionally focused contractors such as Sapura, DeepOcean and Mermaid Subsea, to name but a few. Overall, there appears to be a gap between the coming demand and existing supply. However, it is difficult to enter this market without the necessary equipment and experience.

Lessons Learned from the North Sea

There is a significant opportunity to leverage lessons learned from the North Sea basin. As the industry is more mature, the UK and Norway have established decommissioning regulatory frameworks. The Asia Pacific region is still developing these standards. Initiatives like Thailand’s Petroleum Act amendment and Indonesia’s evolving regulations for abandonment and site restoration are promising steps towards more comprehensive regulations. The region will benefit from engineering best practices and technological advancements that have increased operational efficiencies in the North Sea. This experience can enable cost and time savings for safer and shorter decommissioning campaigns.

EMA's Expertise and Support

EMA provides actionable market intelligence to a range of clients, including field operators, EPCI contractors, vessel owners, equipment makers, and investors. Our data and insight enables them to prepare and execute complex projects in the offshore energy sector.

For enquiries, please contact:

Mikel Watson at michael.watson@energymaritimeassociates.com

or alternatively info@energymaritimeassociates.com

Mike Watson

Mike Watson