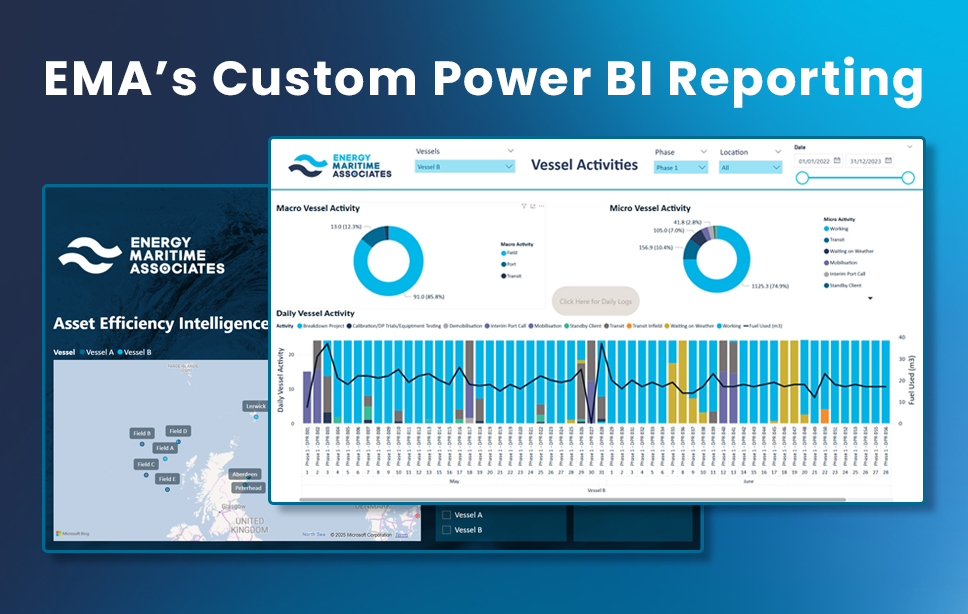

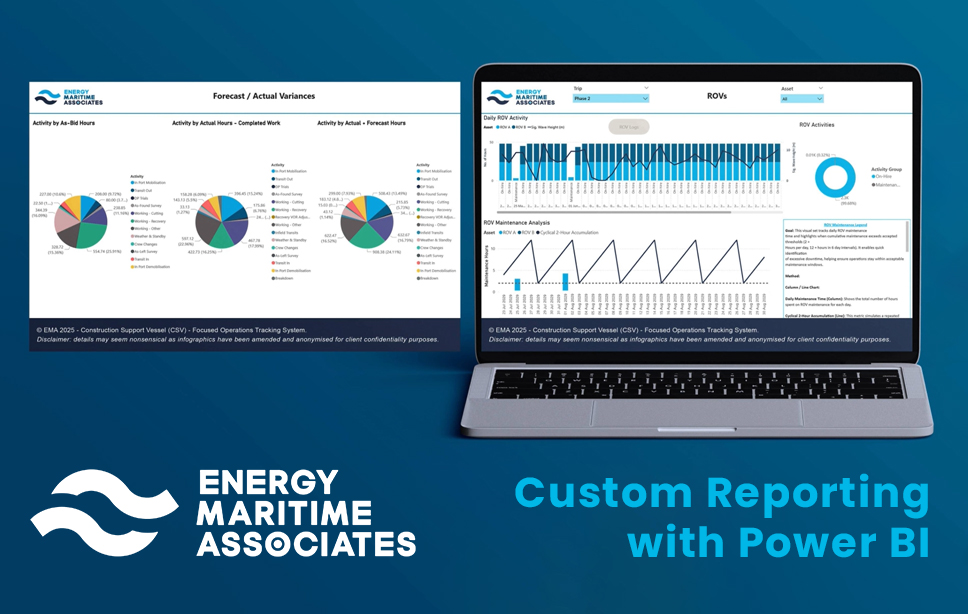

Enhancing Offshore Operational Insights with Custom Power BI Reporting

The offshore energy sector is undergoing a digital transformation. As projects grow in complexity and cost, the need for real-time, data-driven...

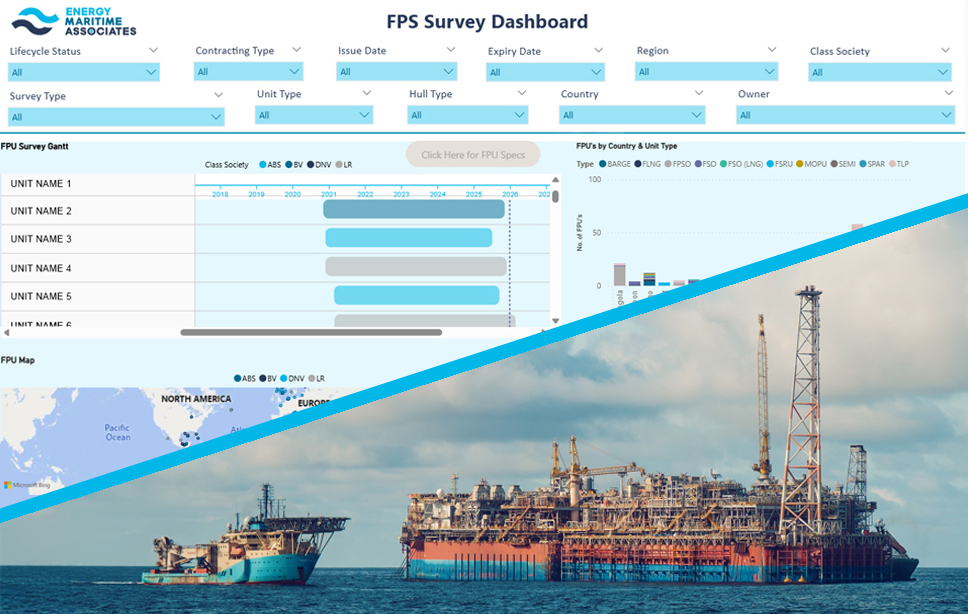

In the offshore industry, timing isn’t just important. It is often the difference between winning work and arriving too late to matter. Among the most reliable indicators of upcoming activity are class-required Special Periodic Surveys (SPS) and related classification milestones. These survey cycles trigger inspection campaigns, maintenance scopes, integrity work, compliance documentation efforts, and readiness support long before a unit ever reaches a drydock or shipyard.

Yet despite their importance, SPS dates and requirements are rarely easy to track. They sit buried across scattered PDFs, inconsistent spreadsheets, classification documents, operator updates, and fragmented fleet trackers. Service providers often find themselves reacting to opportunities only after procurement has already begun, scopes have been defined, and competitors have established early relationships.

When SPS visibility arrives late, service providers lose the chance to influence scope, align partners, and position credentials early. The result is more reactive bidding, weaker technical alignment, and lower win rates. Learn more about how Energy Maritime Associates (EMA) transforms class-driven survey requirements and timelines into actionable intelligence, so teams can move from “Which surveys are coming up?” to “Where will work emerge next, and how do we get in front of it?”.

What This Article Covers:

EMA’s dataset places SPS timelines at the center of a powerful opportunity-identification workflow. The heart of this system is the Issue-to-Expiry survey timeline, which gives clients a detailed, fleet-wide view of:

For service providers, whether they operate in inspection, integrity, structural assessments, maintenance execution, documentation support, or class compliance, these SPS expiry windows become precise leading indicators of upcoming demand.

Instead of discovering work after it has been tendered, EMA helps clients anticipate when a unit will need:

In short, EMA gives teams what they’ve lacked for years: a clean, traceable, reliable pipeline of class-driven opportunity signals.

Every class society administers SPS surveys differently. The cadence, documentation requirements, and specific technical expectations vary between ABS, DNV, Bureau Veritas, Lloyd’s Register, and others. Understanding these differences, and knowing where and when they apply, is crucial for any service provider selling into compliance, inspection, or maintenance scopes.

EMA’s dataset helps clients:

This level of clarity helps clients avoid generic business development approaches and instead engage operators with precisely the compliance support they will need, before the SPS window opens.

Knowing when a SPS is due is only half the battle. Knowing where the unit is operating or being redeployed is equally critical.

EMA allows clients to segment the market by:

This helps teams answer practical questions like:

For companies supporting newbuilds, conversions, or redeployments, EMA’s yard-level intelligence also highlights:

This matters because SPS-related work often expands around newbuild delivery cycles, creating opportunities in commissioning, technical authority approvals, and pre-operational readiness.

Service providers rarely win by targeting everything. They win by targeting what fits their capability envelope.

EMA’s specification filters allow teams to quickly ensure that a unit’s characteristics—water depth, mooring configuration, hull type, lifecycle stage, contracting structure, and operational region—align with what they can deliver.

This prevents wasted pursuit time and strengthens proposal quality for the opportunities they do chase.

EMA clients commonly leverage SPS survey data to:

By filtering units with upcoming SPS deadlines, clients generate targeted outreach lists aligned to their certifications, regions, and strengths.

When multiple units share similar SPS windows, teams can plan mobilizations, inspect-and-maintain bundles, and strategic regional campaigns.

Because newbuilds often require significant pre-survey and class-compliance work, early visibility allows clients to engage yards and operators long before commissioning.

Class-required Special Periodic Surveys are among the offshore sector’s strongest leading indicators of upcoming work. EMA organizes these critical dates, requirements, and signals into an actionable opportunity pipeline, helping clients see what’s coming months or even years before it becomes visible to the broader market.

With EMA, service providers gain the clarity needed to position themselves early, influence scope definition, and win more survey-driven work, long before the window closes.

Want to see how SPS timelines can be filtered by class society, region, unit type, and expiry window to build pursuit lists?

Request a demo to explore EMA’s SPS dataset and workflow.

The offshore energy sector is undergoing a digital transformation. As projects grow in complexity and cost, the need for real-time, data-driven...

Managing and analysis of offshore campaigns requires clear visibility across dozens of operational streams, from HSE performance and personnel...

As the global oil and gas industry pivots towards floating production systems, Energy Maritime Associates (EMA) has released a pivotal report today...